Since the beginning of the year, China has shut down Bitcoin mining farms nationwide. On the one hand, this is an attempt by China to reduce its carbon emissions. On another, the country ostensibly wants to protect its financial system from a volatile asset.

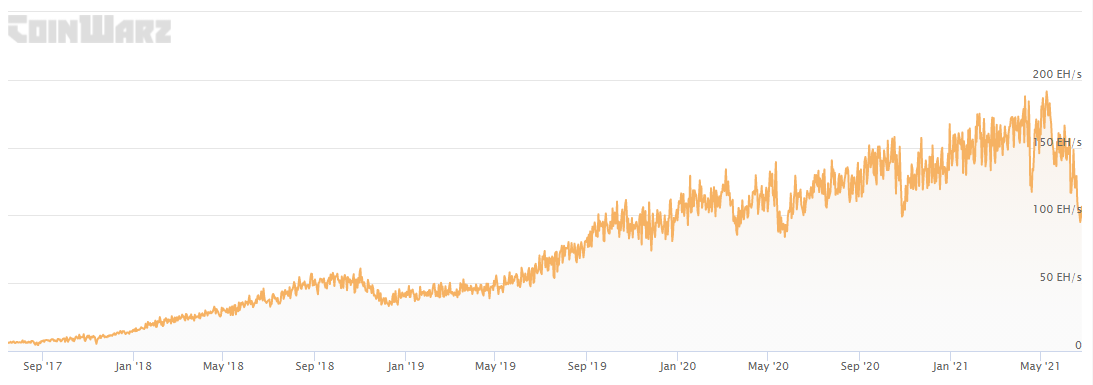

In May, senior economic officials in Beijing announced they would crack down on Bitcoin mining, trading and related services. Sichuan province – known as the hydropower epicentre of China – ordered state-owned power plants to stop supplying more than 20 mining operations. The recent ban not only affected the Bitcoin price, but is also clearly evident in the hashrate. The Bitcoin network is currently ensured with only half the hashrate.

2021 data is not yet available for the global distribution of mining power. Previous estimates have shown that approximately 65% to 75% of the world’s Bitcoin mining occurred in China – mainly in the four Chinese provinces: Xinjiang, Inner Mongolia, Sichuan, and Yunnan. Sichuan and Yunnan are renewable energy meccas due to their hydropower, while Xinjiang and Inner Mongolia are home to many Chinese coal-fired power plants.

Source: Coinwarz

In Inner Mongolia, the miner retreat has already begun after Beijing missed climate targets. The provincial leadership has decided to give Bitcoin miners two months to relocate, explicitly blaming crypto miners for the energy mess.

Mining pools leave China

The three largest mining pools in the world, accounting for about 41% of the hashrate, are considered Chinese pools. However, this does not necessarily mean that they actually operate physical mining facilities in mainland China. How much of the hashrate is in China itself remains unclear. Especially after Beijing’s crackdown on the mining industry and subsequent bans in a number of provinces.

This will create new Bitcoin mining hubs outside of China. While a few miners may continue to benefit from private power plants in Sichuan, this is a noticeable blow to Chinese miners, who are committed to zero carbon emissions. Sichuan was the perfect example of how Bitcoin mining is becoming more sustainable from a carbon footprint perspective with renewable energy.

Where these migrating miners end up could prove to be a crucial question for Bitcoin’s future. It is important to note that the use of hydroelectric power in the U.S. avoids about 200 million tons of carbon pollution each year, the equivalent of producing more than 38 million passenger cars.

North America becomes attractive for Bitcoin mining

Recent restrictions on mining activities in China have accelerated the move of Bitcoin mining to North America. American companies like Square have pledged to support “green” Bitcoin mining with $10 million. Elon Musk and MicroStrategy CEO Michael Saylor held a private meeting with miners from North America. They plan to create a body that will disclose energy consumption in a standardized way and promote the use of renewable energy in the world. This is expected to lead to more Bitcoin mining initiatives using renewable energy sources.

“Texas not only has the cheapest electricity in the U.S., but is also among the cheapest in the world. It’s very easy to start a mining company … if you have $30 or $40 million, you can become a leading mining company in the United States.” – Brandon Arvanaghi, security engineer at crypto exchange Gemini

The reliability of the Texas power grid is perhaps the biggest issue here. A storm devastated much of the state in 2021. This reignited the debate over whether Texas should winterize its systems – a potentially costly project that could impact taxes or other fees for those who want to tap into the state’s power grid. Recently, the operator of the Texas electric grid (ERCOT) urged consumers to conserve energy in light of an unusual number of “forced generation outages” and an impending heat wave.

Global effects

Finally, ESG includes social and administrative aspects that are often overlooked in Bitcoin. Indeed, the cryptoasset offers up the option of an alternative financial asset and monetary system that is accessible to anyone with an internet connection. Thus, the Bitcoin network knows no discrimination. Even the Human Rights Foundation has stated that Bitcoin can serve as an alternative and censorship-resistant financial system to protect human rights.

Transactions go directly from one person to another. Payment processing is not done by a regulated company, but by a decentralized global software network. If someone types or pronounces a wrong word in China, the Communist Party can stop all financial services. This devastating outcome creates a chilling effect for dissidents and creative minds forced to use the country’s increasingly centralized digital economy.

*Originally posted at CVJ.CH