Innovations of blockchain-based banking have recently gained a lot of traction. The architecture of decentralized finance (DeFi) can create an immutable and highly interoperable financial system with unprecedented transparency, equal access rights, and little need for custodians.

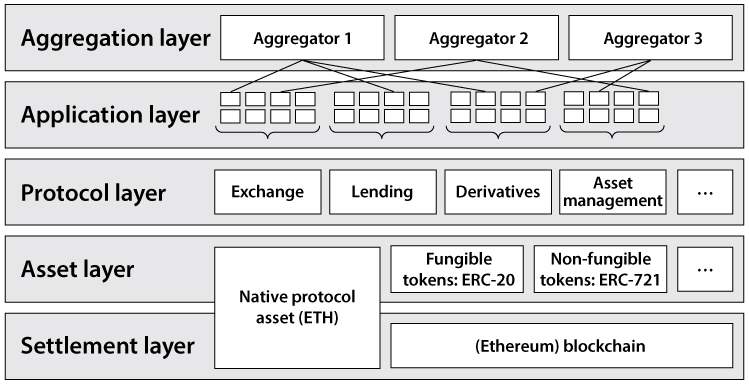

The St. Louis Federal Reserve Bank has recently published an in-depth paper by Prof. Fabian Schär on the sector of decentralized finance (DeFi). They propose a multi-layered framework to analyze the implicit architecture and the various DeFi building blocks. Blocks including token standards, decentralized exchanges and debt markets, but also blockchain derivatives and on-chain asset management protocols without custodians.

Ecosystem for open and permissionless banking

The new ecosystem can create new financial instruments, not only for distributed lending and borrowing, but also for different assets and the unbanked. This makes it easy to trade crypto assets and tokenized versions of stocks or other real world goods on decentralized markets. Other examples of smart contract applications are atomic swaps, autonomous liquidity pools, decentralized stablecoins, and flash loans. DeFi recently crossed 35 billion USD in TVL, which doesn’t reflect transactions, but rather refers to total value locked in protocols.

While replicating the existing financial services in an open and transparent way, intermediaries and their additional fees can be avoided completely. The self-determination of the Individual might also experience a comeback. Early users need to understand that they are “beta testers” though, which includes taking on the risk that banks usually handle. On top of that most implementations in DeFi are limited to ERC-20 tokens on the Ethereum blockchain. They heavily also depend on price oracles and third-party protocols. If a smart contract has an issue or an oracle gets tricked, the consequences could affect multiple applications and end users.

Democratization of Finance

The opportunities for a transparent, efficient and decentralized financial-system, without any third parties, are immense. According to the St. Louis Fed, DeFi has the potential to create a path towards a more open and transparent future. The largest concern for the Federal Reserve is currently the regulatory uncertainty. Regulators need to understand the democratic potential of open decentralized protocols before it can be used to the fullest.

When done right, DeFi could also be called the Democratization of Finance. If well-known companies have to invest transparently and smart contracts set the restrictions, there would be less need for politics and lobbying. There might be less shadow-banking and investments into polluting or otherwise malicious companies.

*Originally posted at CVJ.CH