Payoff, the investor portal focusing on structured products, again presented the Swiss Derivative Awards this year. The most innovative products in various categories were honoured. A Bitcoin Reverse Convertible was chosen as the best product on alternative underlyings.

For the fifteenth time, the Swiss Derivative Awards 2020 honoured the best structured products and their issuers. For the first time, awards were presented for two categories specifically focused on environmental protection (ESG and climate protection).

The jury, consisting of experts from asset management companies, the SIX Swiss Exchange, and the Universities of Fribourg and Zurich, selected the winners in the various categories. All products issued in Switzerland in 2019 or earlier and listed on SIX Swiss Exchange were admitted. The expert panel named three favourites in each category. All winners and nominees were then determined after a counting procedure and confirmed by the jury chairman.

RCXBTQ – World’s first exchange-traded reverse convertible on Bitcoin

In the category “Best Product on Alternative Underlyings”, the jury selected the Reverse Convertible RCXBTQ on Bitcoin from Leonteq Securities as the winner. This was the first reverse convertible on Bitcoin in the world that could be traded on an exchange. This innovation was launched at a time when the environment for crypto-currencies was anything but easy.

The product type first applied to Bitcoin by the issuer eliminated a white spot in the product range. Thanks to the high volatility, above-average coupons can be offered in the case of the crypto currency. – Dieter Haas, Payoff.ch

The timing of the innovation was suboptimal due to the short three-month term from September 19 to December 27, 2019, because shortly after the fixation on September 19, the crypto currency suffered a weakening attack. Nevertheless, the risk profile of the reverse convertible enabled the investor to achieve an absolute coupon of 10% in three months. Looking at the product from the time of issue at the end of September, investors were able to reduce their losses significantly compared to a direct investment, thanks to the attractive coupon.

The issuer Leonteq has since expanded its range of reverse convertibles on Bitcoin with additional products. The latest products include coupons of 11.4% and 11.44% with a six-month maturity and exercise prices of USD 8,000 and USD 7,000 respectively.

Reverse convertibles

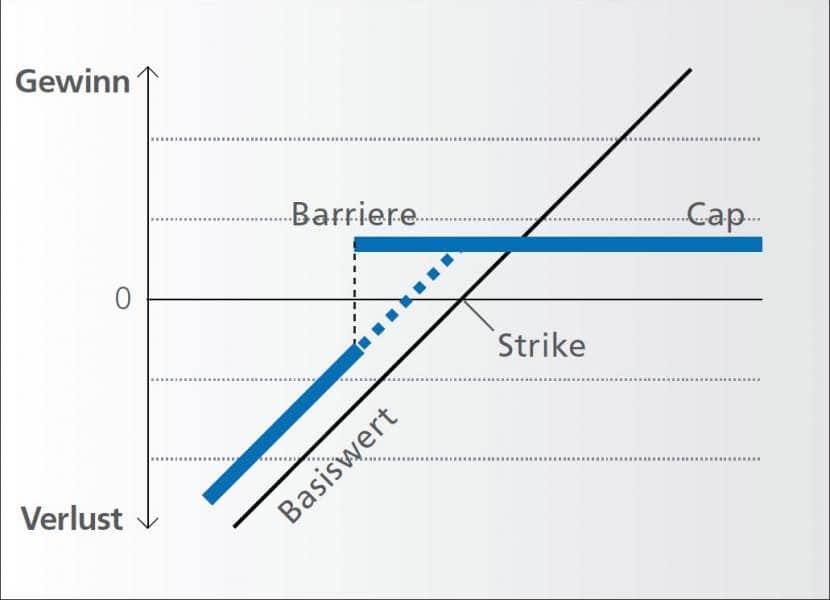

Reverse convertibles are among the most popular products in Switzerland. They are often used in the “yield optimization” category. The investor expects the market to trend sideways or to rise slightly. Reverse convertibles contain a coupon that corresponds to the maximum yield.

If the underlying closes below the strike price on the expiration date, the investor receives the denomination reduced proportionally to the negative price performance. If it closes above this level, the investor receives the nominal value. The Coupon will be paid out at maturity.

A reverse convertible is particularly suitable for investors who expect the underlying instrument to move sideways and wish to benefit from a secured cash flow in the form of a coupon. The amount of the coupon depends primarily on the premium income from the corresponding put option sold. The more an underlying asset fluctuates (the higher its volatility), the more expensive the put option can be sold and the more attractive the coupon.

*Originally published in German at CVJ.ch