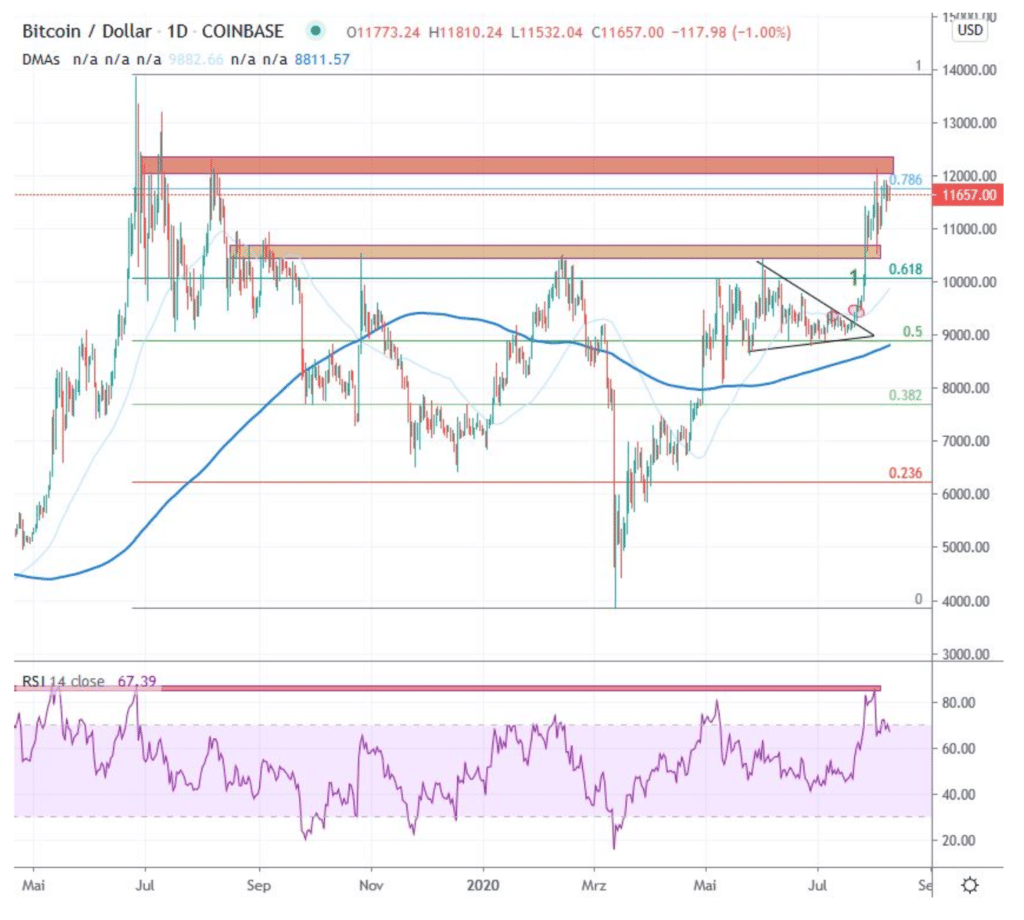

Bitcoin/USD daily basis

Bitcoin USD – consolidation at a new level

After the considerable price increase of the previous week, the current reporting week was dominated by a consolidation at the newly reached level. The first test of the sustainability of the recent outbreak took place on Sunday a week ago. After reaching a new all-time high of USD 12,150, a sell-off followed on the same day, bringing the price to a daily low of USD 10,500 – with the daily close again above USD 11,000. After a consolidation around 11,000 USD at the beginning of the week, the Bitcoin price rose again on Wednesday. The result was a daily closing price just over USD 11,700 close to the daily high. The following days were marked by a consolidation until the end of the week, with low trading margins around 11’700 USD.

Breakthrough through historical resistance

A veritable countermovement established itself after the price slump of mid-March. This led up to the resistance zones starting at USD 10,000. After a renewed rejection at the beginning of June, a consolidation period of almost two months was observed. This was characterised by a series of higher daily lows and lower daily highs (triangle). The series of lower highs was broken on 22 July (markings). This was followed on July 27 by a break through the resistance zone around USD 10,500, which has been established since August 2019 and which Bitcoin has already failed to break several times.

The resistance zone around USD 10,000 was interesting in several respects. For one thing, it contains the 0.618 Fibonacci point (1) of the entire downtrend, which was heralded at the end of June 2019 just below USD 14,000. Secondly, the zone around USD 10,000 simultaneously served as a confirmation of the still bearish trend of lower highs since December 2017 (see next section).

What can now confirm the sustainability of the recent breakout is an establishment above the historical resistance at $10,500 which now serves as support (green). A current correction after the rapid price increase is not a break of the leg and should be considered healthy. Thereby, the new support at 10’500 USD should be respected in the best case. A further support is located around 9’500 USD, which was created by the trading activity since the beginning of May. This is also where the 200-day average is located. The RSI indicator in the daily interval could meanwhile move away from its extreme values, which were last reached at the bull run of April 2019.

The next resistance level to be overcome is just above USD 12,000. Should this be permanently overcome, there is little resistance left until the all-time high of December 2017 and the probability of a sustained trend reversal would be high.

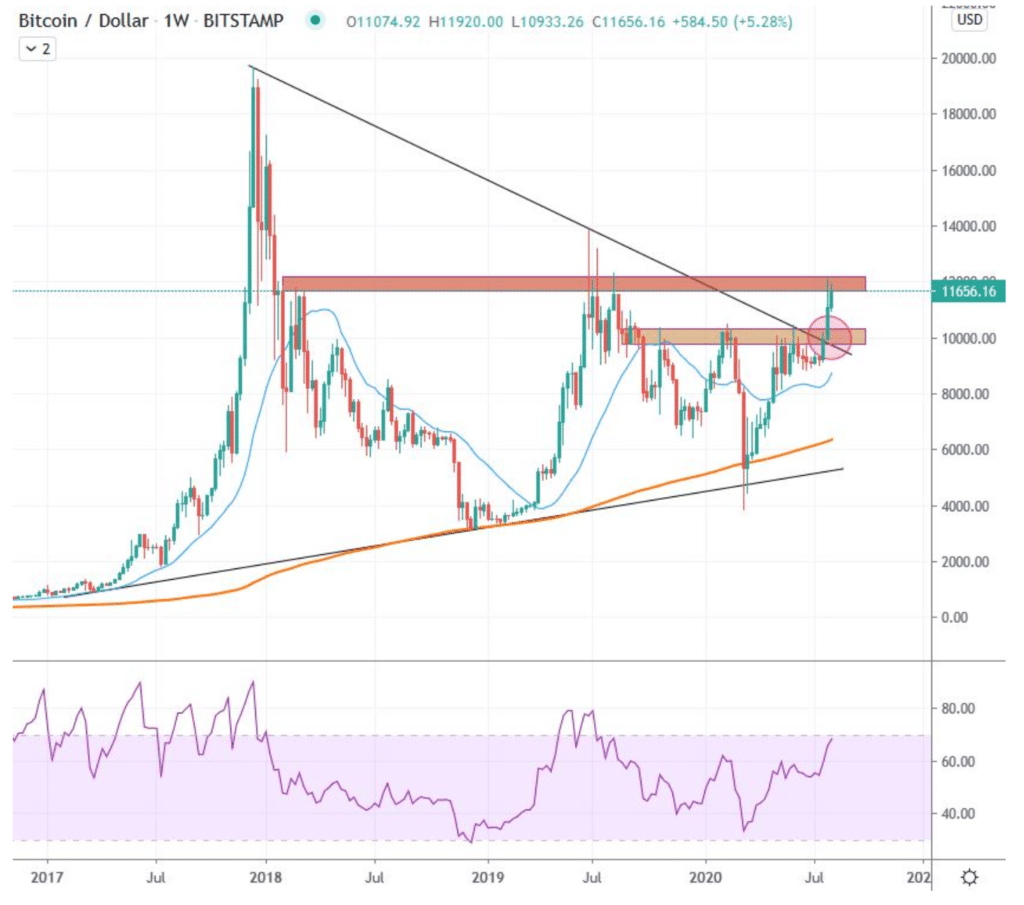

Macro: Series of lower highs broken since the end of 2017

Bitcoin set a higher high for the first time in the weekly interval, breaking the prevailing bearish trend since December 2017. The series of lower highs, which stretched over 135 weeks, was thus interrupted (marker).

In order to change the negative macro picture into a valid trend reversal, the breakout should be legitimized with several weekly candles above the USD 10,000 mark.

An establishment above USD 10,000 and a consistent overcoming of the resistance around USD 12,000 over the next few weeks speak for the legitimacy of the trend reversal. Should the Bitcoin price then consolidate above USD 12,000 again, the chances of an attack on the all-time high of a good USD 20,000 would certainly exist.

A drop in the price that would bring the price back into the USD 9,500 range and below over several weeks would damage the positive momentum and argue for a longer consolidation.

Disclaimer

All information in this publication is for general information purposes only. The information provided in this publication does not constitute investment advice and is not intended as such. This publication does not constitute an offer, recommendation or solicitation for an investment in any financial instrument including crypto currencies and the like and is not intended as an offer, recommendation or solicitation. The contents contained in the publication represent the personal opinion of the respective authors and are not suitable or intended as a basis for a decision.

Notice of risk

Investments and investments, especially in crypto-currencies, are generally associated with risk. The total loss of the invested capital cannot be excluded. Crypto-currencies are very volatile and can therefore be subject to extreme exchange rate fluctuations within a short period of time.

*Originally published in German at CVJ.ch