A recently published study analyzed the relevance of crypto-currencies among German stock corporations. According to the study, crypto’s such as Bitcoin have so far been of secondary importance for the corporations.

The study examined the adaptation of crypto currencies among listed German companies. The authors Lars Andraschko and Bernd Britzelmaier from the Business School Pforzheim researched various aspects of German companies in dealing with crypto currencies. For example, they investigated whether the companies surveyed would achieve competitive advantages in the future by introducing crypto-currencies. The integration of crypto-currencies into their own business model or investments in the area were also discussed. The empirical survey was conducted among 31 CFOs of listed German companies.

Blockchain technology preferred over crypto currencies

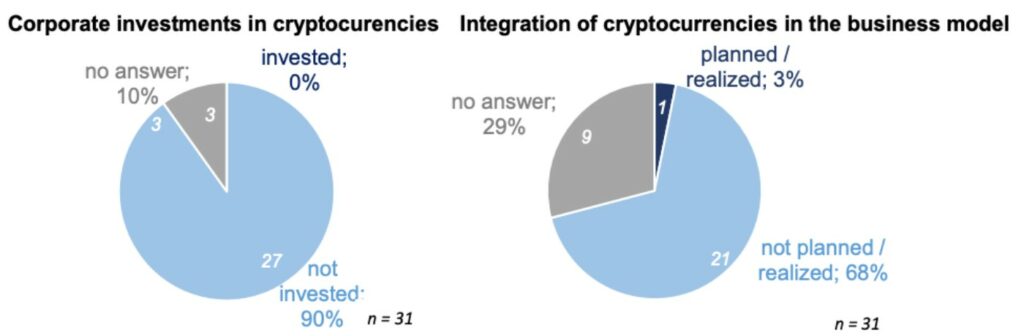

Only about 10 percent of the companies consider an investment in digital currencies such as Bitcoin to be worthwhile. However, none of the companies surveyed have invested. However, there is a general rejection of crypto currencies among the German capital market-oriented companies surveyed.

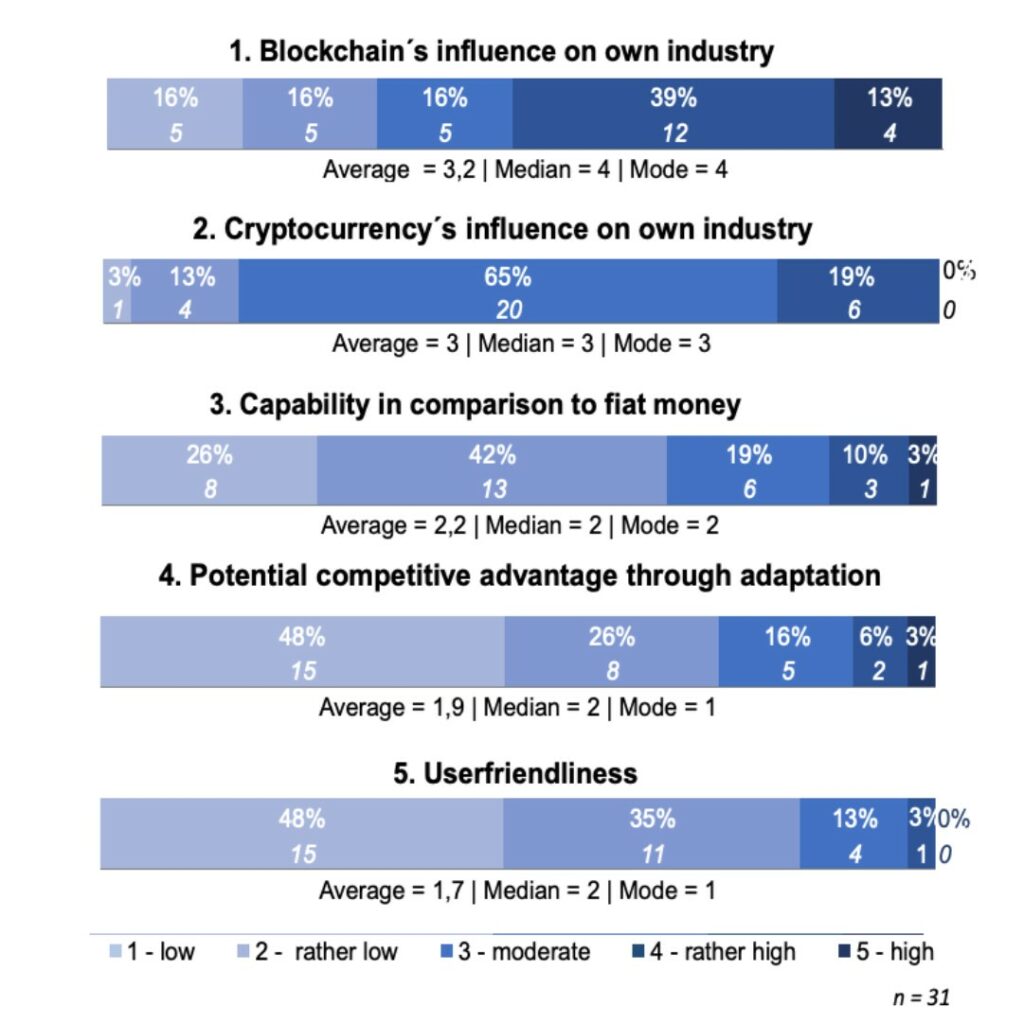

Only one group was convinced of the actual integration of crypto-currencies into an existing business model. However, it turned out that companies think a lot about the underlying blockchain technology. More than a quarter of the respondents indicated that they see potential advantages in connection with the Internet of Things (IoT) and in the processing of small payments (micropayments).

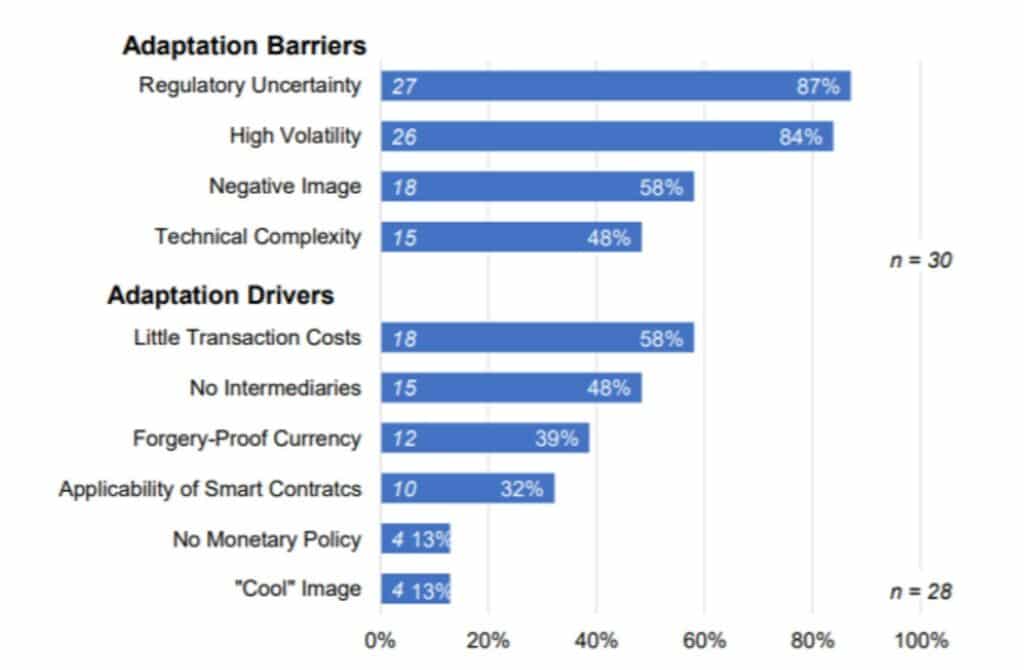

Regulatory uncertainties and volatility are seen as the biggest barriers

Respondents see possible obstacles in regulatory uncertainty and high price volatility. The opportunities cited included low transaction costs and the elimination of superfluous intermediaries. For a further adaptation of crypto-currencies, the CFOs see mainly the need for increased user-friendliness, long-term price stability and clear regulation.

With regard to improvements at the regulatory level, however, progress is constantly being made in Germany. For example, BaFin has approved the custody and sale of crypto-currencies by banks from 2020.

*Originally published in German at CVJ.ch